2004-01-19

Experts at HCD Group prepared research on the St. Petersburg hotel market from 1998 until May 2003.

Experts at HCD Group completed an analysis of the St. Petersburg hotel market from 1998 until May 2003. The market report considered the following trends:

·

Evolution of the Hotel Supply in the City;

·

Travel and Lodging Patterns of Domestic and Foreign Visitors to St. Petersburg;

·

Geographic Origin of Hotel Demand For St. Petersburg Hotels;

·

St. Petersburg’s Market Share In Comparison to Regional and National Accommodation Supply;

·

Segmentation of the Customer Base for St. Petersburg Hotels by Purpose of Travel;

·

Average Occupancy and ADR in St. Petersburg Hotels;

·

Growth in Conference Activity in St. Petersburg Hotels;

·

The analysis of Passenger Traffic at St. Petersburg Airport.

The hotel market in St. Petersburg is second behind Moscow in terms of supply and demand.

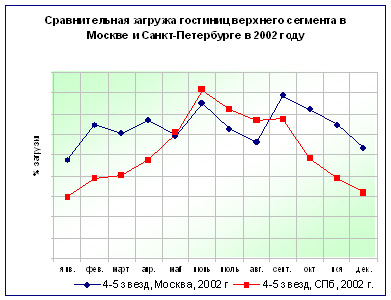

Although the existing hotel supply in St. Petersburg principally targets urban demand, the St. Petersburg market distinguishes itself considerably from Moscow in the frequency of hotel demand. Demand for St. Petersburg market is characterized by high seasonality with peaks in May-June and sharp drops in the autumn and winter seasons. In Moscow, hotel occupancy is more even throughout the year, though seasonality has been more pronounced in recent years than in the past. The strongest hotel demand in Moscow and St. Petersburg lies in the 4 and 5 star categories. Nevertheless, demand for the upper segment is still much less saturated than in the capital. Reasons for this situation can be attributed in due part to the 1998 ruble crash. In both cities, the financial crisis mostly affected hotels in the upper segment, but in St. Petersburg, its negative impact was much milder and rapidly overcome.

The hotel market in St. Petersburg is second behind Moscow in terms of supply and demand.

Although the existing hotel supply in St. Petersburg principally targets urban demand, the St. Petersburg market distinguishes itself considerably from Moscow in the frequency of hotel demand. Demand for St. Petersburg market is characterized by high seasonality with peaks in May-June and sharp drops in the autumn and winter seasons. In Moscow, hotel occupancy is more even throughout the year, though seasonality has been more pronounced in recent years than in the past. The strongest hotel demand in Moscow and St. Petersburg lies in the 4 and 5 star categories. Nevertheless, demand for the upper segment is still much less saturated than in the capital. Reasons for this situation can be attributed in due part to the 1998 ruble crash. In both cities, the financial crisis mostly affected hotels in the upper segment, but in St. Petersburg, its negative impact was much milder and rapidly overcome.

In view of lower competition for market share amongst the leading hotel players positioned in the top segment in St. Petersburg, such hoteliers find it easier to sell their room nights at much higher rates than is possible in Moscow. This almost auction-like increases in room rates is most evident during the “white nights” period”, when demand for accommodation in the Northern Capital reaches its peak. As a result of the recovery of top segment hotels in St. Petersburg , the seasonal fluctuations in demand and room tariffs soared. During the recovery phase, not only peak Average Daily Rate but also the range rate fluctuations between peak and low seasons was estimated at over 100%.

In view of lower competition for market share amongst the leading hotel players positioned in the top segment in St. Petersburg, such hoteliers find it easier to sell their room nights at much higher rates than is possible in Moscow. This almost auction-like increases in room rates is most evident during the “white nights” period”, when demand for accommodation in the Northern Capital reaches its peak. As a result of the recovery of top segment hotels in St. Petersburg , the seasonal fluctuations in demand and room tariffs soared. During the recovery phase, not only peak Average Daily Rate but also the range rate fluctuations between peak and low seasons was estimated at over 100%.

Although there has been some growth in seasonality in recent yeas in Moscow, the difference between peak and low seasonal room prices fluctuates only around 15%, thus reflecting a more stable and predictable behavioral pattern of yearly demand than St. Petersburg.

|